Key Takeaways:

- ETF expert Nate Geraci suggests BlackRock could file for an iShares XRP ETF following the end of the Ripple lawsuit.

- Ripple and the SEC have jointly dismissed all remaining appeals, affirming XRP is not a security in retail transactions.

- Market reaction: XRP surges over 13% in 24 hours; Polymarket odds for an XRP ETF approval jump to 88%.

The conclusion of Ripple’s years-long legal battle with the U.S. Securities and Exchange Commission (SEC) has reignited speculation about a potential BlackRock XRP exchange-traded fund (ETF). Legal clarity surrounding XRP’s status has removed a major barrier to institutional products tied to the token, and some industry experts believe the world’s largest asset manager may soon expand its crypto ETF lineup beyond Bitcoin and Ethereum.

Read More: Ripple’s Game-Changing Move: Wormhole Integration Unlocks $60B Cross-Chain Potential

Ripple Lawsuit Officially Ends, XRP’s Status Confirmed

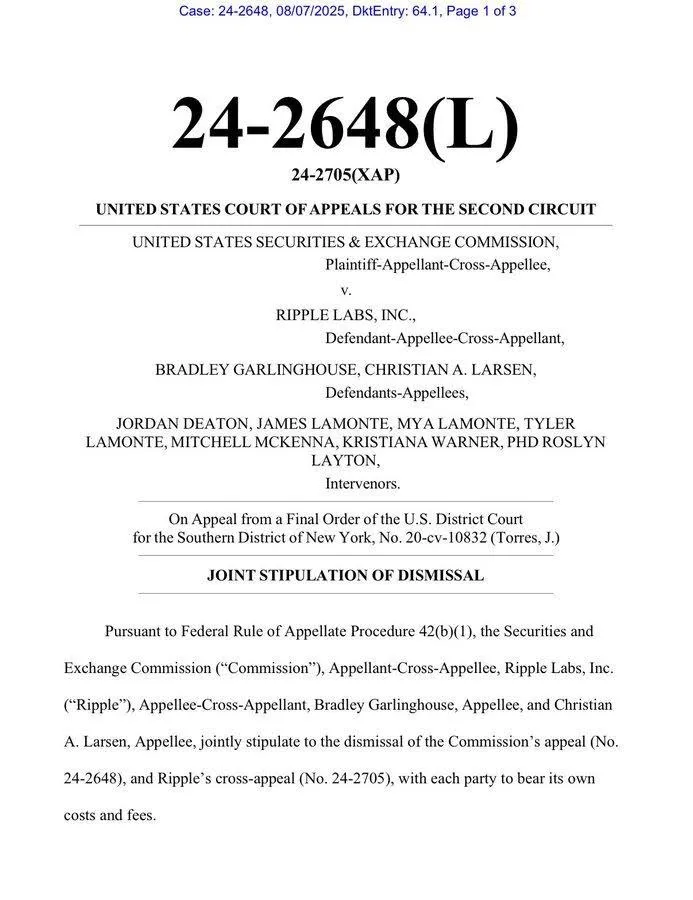

On August 7, Ripple and the SEC filed a joint dismissal of all remaining appeals in their case, marking the official end to a legal saga that began in December 2020. The dismissal cements a significant precedent: XRP is not considered a security when traded in retail transactions.

For years, the lawsuit cast a shadow over XRP’s market potential in the U.S., limiting its inclusion in exchange listings, payment platforms, and regulated investment products. With the case now closed, U.S.-based exchanges and financial firms have greater freedom to list XRP and create derivative products based on it.

Ripple wasted no time in capitalizing on this legal clarity. Just before the dismissal was filed, the company announced its $200 million acquisition of Rail, a Toronto-based stablecoin payments platform. The move is aimed at enhancing infrastructure for Ripple’s RLUSD stablecoin project, signaling that the firm is accelerating its broader expansion plans.

Read More: Ripple Acquires Rail in $200M Move to Dominate Stablecoin Market

ETF Expert Flags BlackRock’s Potential Entry into XRP Market

In a post on X (formerly Twitter), Nate Geraci, president of The ETF Store, said he believes BlackRock was “waiting to see this” before potentially filing for an iShares XRP ETF.

“Makes zero sense for them to ignore crypto assets beyond BTC & ETH,” Geraci wrote. “Otherwise, they’re basically saying those are the only ones that will ever have value.”

Geraci’s comments reflect a growing sentiment in the market: with legal uncertainty resolved, the pathway for an XRP ETF is much clearer. BlackRock, already managing the largest Bitcoin ETF in the world and an Ethereum ETF, has the resources, brand recognition, and regulatory expertise to bring such a product to market quickly.

Not all the analysts however believe that a filing is imminent. Eric Balchunas, a senior ETF analyst at Bloomberg, was skeptical, however, saying that BlackRock might like to continue to work with BTC and ETH since it no longer makes sense to continue to add crypto-based ETFs to its portfolio.

“I think they’re happy with the two,” Balchunas said, while acknowledging his position was more “gut feeling” than based on concrete evidence.

Read More: BlackRock’s $547M Ethereum Bet Signals Bold Pivot, 5x Heavier ETH Focus Than Bitcoin

Market Response Signals Strong Demand

The crypto market reacted swiftly to the lawsuit’s conclusion. XRP surged over 13.27% within 24 hours, far outpacing the broader cryptocurrency market’s 3.75% gain over the same period. On South Korean exchanges, XRP trading volume skyrocketed by 1,211%, indicating strong international interest.

Derivatives markets also saw a surge in activity. Traders on Deribit purchased over 100,000 call and put contracts at $3.20 and $3.10 strike prices, paying a total of $416,000 in premiums. These positions suggest that market participants expect heightened volatility in the coming weeks.

Spot markets were equally active. Net inflows exceeding $42 million briefly pushed XRP above $3.30, with a peak at $3.32, raising its total market capitalization to $22 billion.

ETF Approval Odds Rise

The legal resolution has also influenced prediction markets. On Polymarket, odds for an XRP ETF approval surged to 88%, recovering from a recent low of around 65%. The earlier dip came after SEC Commissioner Caroline Crenshaw voted against certain crypto-related measures, a move analysts like Balchunas dismissed as routine, given her consistent opposition to all crypto ETFs.

Advocates say that a BlackRock XRP ETF would be strategically sound. It would extend the variety of crypto products offered by the firm, cater to the interests of institutions, who want to have exposure to a wider crypto asset range, and follow the tendencies in the fast-evolving crypto investment sphere.

The concept of going beyond Bitcoin and Ethereum to enter mixed institutional crypto exposure has been prevailing. Although these two assets monopolize the market capitalization and institutional purchasing, other tokens such as XRP come with specific use cases – the latter is cross-border payments and settlement efficiency.

The post BlackRock XRP ETF Speculation Heats Up After Ripple Lawsuit Resolution appeared first on CryptoNinjas.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments